¡Oh, vamos! ¡Los rumores sobre la temporada de altcoin están volando más rápido que un comerciante criptográfico en una carrera de azúcar! 🚀 Ethereum ha estado en una montaña rusa, China acaba de anunciar un estímulo (porque nada dice ‘recuperación económica’ como un poco más de deuda), y la Fed está insinuando recortes de tasas en septiembre. Pero aquí está el pateador: el experto en Deribit dice que todavía no está sucediendo. 🤯

Sin embargo, según un experto en el Deribit de Exchange Crypto Exchange adquirido de Coinbase, la temporada de altcoin permanece en espera. El panorama actual sugiere un optimismo cauteloso en lugar de la euforia extrema. Si bien Ethereum ha aumentado, no ha alcanzado el umbral requerido para confirmar tal evento, y las altcoins de mediana y pequeña capitalización aún carecen de un volumen comercial suficiente. 🤷♀️

¿Están finalmente los factores macro finalmente alineados? ¿O es solo una versión criptográfica de ‘No voy a caer por eso otra vez’? 🤔

Para muchos comerciantes de criptomonedas, el atractivo de la temporada de altcoin es el equivalente criptográfico de una fiebre del oro. Este período representa un cambio de mercado de titanes establecidos como Bitcoin y Ethereum hacia una constelación más amplia de activos más pequeños y más especulativos. Tal evento culmina en una tendencia de ganancias explosivas. 🎯

Los factores macroeconómicos actuales y ciertas métricas en cadena han sugerido la llegada de la temporada de altcoins de larga esperanza. 📈

Altcoin Season starts in September 2025

The Golden Accumulation ends next week, and lowcaps will pump 100-150x.

Those who buy alts now will be millionaires by the end of this cycle.

Here’s what I’m buying ahead of the biggest Bull Run in history

– Chiefy (@0xChiefy) August 22, 2025

In a speech today at the Jackson Hole Economic Symposium, US Federal Reserve Chair Jerome Powell indicated a more dovish stance toward possibly lowering interest rates. He hinted that «the shifting balance of risks» could warrant adjusting the Fed’s policy stance, hinting at potential expansionary policies for September. 🧠

Earlier this week, reports emerged that China had announced a new stimulus package to bolster its struggling economy. While details are still emerging, the move was widely seen as a significant step toward policy easing by one of the world’s largest economies. 🍬

Jean-David Péquignot, Deribit’s Chief Commercial Officer, recognized the confluence of favorable macroeconomic policies as key triggers for a potential altcoin season. 🤝

«Loosening central bank policies can reduce yields on safer assets and inject liquidity into the financial system, lowering long-term return expectations… As a high-beta risk asset, crypto tends to amplify what’s happening in equities, and when liquidity is more abundant, speculative flows increase,» Péquignot told BeInCrypto. 📊

Ethereum’s consequent price surge reinforced these expectations. 🚀

Ethereum’s Rally Sparks Hope (But Is It a Mirage?) 🌟

In a powerful display of renewed risk appetite among investors, Ethereum’s price rallied following Powell’s announcement. This price action and a recent surge in inflows into spot Ethereum ETFs represent key developments. 📈

According to Péquignot’s analysis, the outperformance of Ethereum relative to Bitcoin is a crucial signal for the broader market. 🧠

«The ETH/BTC ratio typically acts as a leading indicator when BTC starts underperforming and investors show an increasing appetite for higher-risk crypto assets,» he said, adding, «[It] can also have a spillover effect, where Ether outperformance consolidates investor appetite for innovation and triggers FOMO in the broader market.» 🤯

Despite these promising signs, they are still not enough to confirm the arrival of a full-blown altcoin season. 🤷♂️

Bitcoin Still Dominates (And It’s Not Happy About It) 🏰

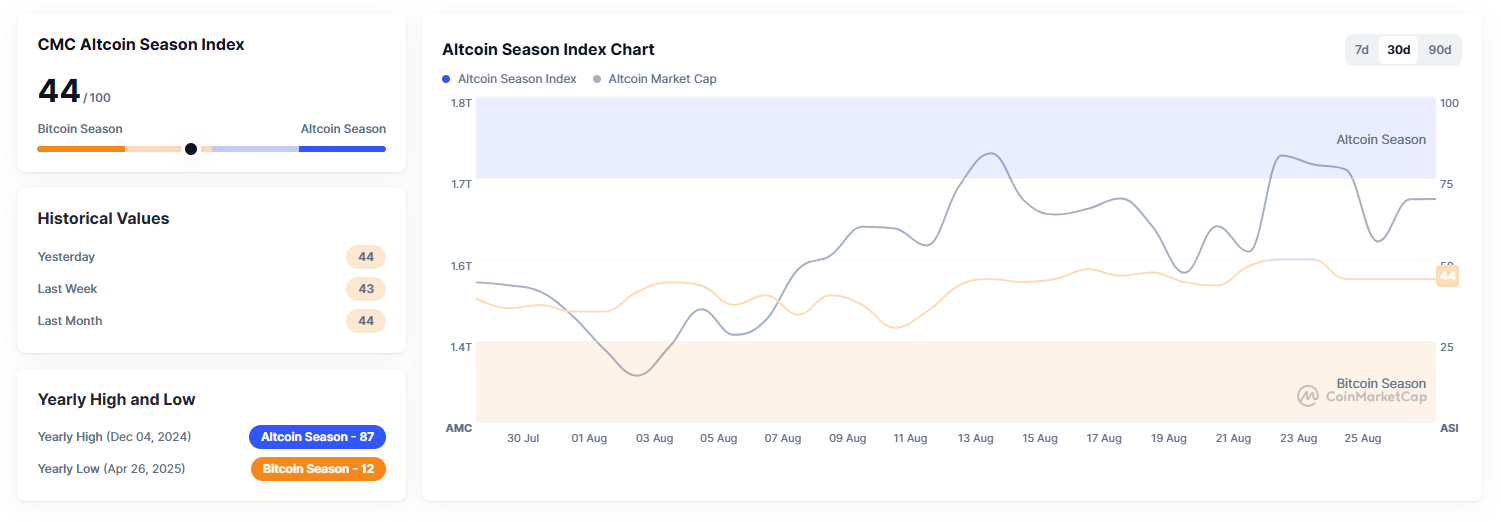

A broad market rally defines a true altcoin season, yet several key metrics indicate this has not yet happened. The CoinMarketCap Altcoin Season Index, for example, measures whether 75% of the top 100 altcoins have outperformed Bitcoin over 90 days. 📊

At press time, the index stood at 44 out of 100. 📉

«The CMC Altcoin Season Index has also recovered but remains well below the key level of 75. Many mid- and small-cap alts are still lagging or trading sideways, showing no widespread altcoin outperformance,» said Péquignot.

Meanwhile, Bitcoin still has a stranglehold on the crypto market. 🤖

«Bitcoin dominance remains high on a 5-year horizon at 58%, to the point BTC prevails as the primary catalyst for institutional allocation in particular,» Péquignot added.

These indicators suggest that capital is still primarily concentrated in Bitcoin, often considered the safest digital asset. For altcoin season to truly arrive, these metrics will need to change. 🤷♀️

What Factors Are Needed to Jumpstart Altcoin Season? (Spoiler: It’s Complicated) 🧠

While the recent news has provided significant momentum, Péquignot is waiting for a combination of all factors to fully align before he is confident in making the call. He explained that true altcoin season is signaled by a series of events confirming a widespread investor behavior shift. 🤯

«A breakout of the ETH/BTC ratio signalling sustained BTC underperformance; a decisive fall in BTC dominance, showing more obvious capital rotation; the Altcoin Season Index pushing towards 75, confirming large altcoin breadth expansion; and larger retail inflows evidenced by on-chain activity, social media activity, and larger altcoin trading volumes,» he explained. 📈

This broad-based capital rotation, combined with macro tailwinds from the world’s strongest economies, could be enough to reroute liquidity into altcs. Yet, even with these positive developments, the path is not without risk. 🚨

Final Triggers and Potential Pitfalls (Because Nothing’s Ever Simple) 🚧

Several factors could derail a potential rally. For example, changes in central bank policy could reverse the current trend. 🧠

«Sudden higher inflation prints may force central banks to pause or reverse easing earlier than anticipated, which would hurt risk assets and revert the capital rotation,» Péquignot told BeInCrypto. 📉

He also cautioned that the crypto market’s dynamics, particularly the high use of leverage, can lead to sharp corrections. 🤯

«As altcoin rallies are fouled by retail greed and large leverage, overcrowded or disappointing investment narratives can lead to profit taking or loss limitations, triggering liquidations that can cut short any altcoin season,» Péquignot added.

Adding to the fire, the ongoing imposition and reversal of trade tariffs by the United States continues to fuel persistent uncertainty among investors. Such an environment can quickly dampen altcoin appetite. 🚫

The Waiting Game (And It’s Drilling Into Our Nerves) 🕒

Altcoin season will require more patience this year. Though it still hasn’t arrived, the conditions are building. 🧠

The powerful combination of macroeconomic tailwinds and Ethereum’s recent surge has provided the strongest signal to date that the market is beginning to shift. However, all the necessary indicators to confirm such an event haven’t yet been met. 🤷♂️

The waiting game continues, but for the first time in a long time, the pieces for the next great crypto gold rush appear to be falling into place. 🎉

- USD MXN PRONOSTICO

- LTC PRONOSTICO. LTC criptomoneda

- BNB PRONOSTICO. BNB criptomoneda

- USD CLP PRONOSTICO

- XRP PRONOSTICO. XRP criptomoneda

- FET PRONOSTICO. FET criptomoneda

- TRUMP PRONOSTICO. TRUMP criptomoneda

- USD PLN PRONOSTICO

- STETH PRONOSTICO. STETH criptomoneda

- BTC PRONOSTICO. BTC criptomoneda

2025-08-27 23:30