ah, querido lector, has entrado en el salón de criptografía, un lugar donde se forjan fortunas antes del té y la reputación se arruina justo a tiempo para el almuerzo. 🥂 ¿Te preocupas por un escándalo matutino? ¡Por supuesto que lo haces!

Tome su café como un caballero para la batalla: Ripple, ese apuesto, si a menudo, el Scion of Digital Finance, ha decidido, con bastante sentido, confiar la santidad de sus reservas RLUSD a nada menos que el venerable Bny Mellon. ¿Por qué confiar en una startup de criptografía con su fortuna cuando simplemente podría convocar a los custodios de $ 43 billones en el cambio repuesto de la civilización? 😏

El efecto de ondulación: banqueros, blockchains y otros hábitos caros

Con Bny Mellon en su brazo, Ripple ahora gira sobre el piso de la sala de baile, disfrutando de las miradas de las matronas tradicionales y los debutantes Defi por igual. ¿Los deberes del custodio? Nada menos que mantenga a RLUSD, el estrictamente respaldado por el dólar de Ripple, está bien moderado, sobrio y no inclinado a huir a Las Vegas.

Las bóvedas legendarias de BNY, Rumor tienen más oro que en las pesadillas de Midas, también manejarán la banca de transacciones, por lo que las operaciones de RLUSD no se convertirán en el caos (o, el cielo no lo quiera, una cena familiar).

Ripple ha seleccionado a @BnyGlobal como el custodio de las reservas principales para $ RLUSD, un stablecoin de grado empresarial construido para la utilidad del mundo real, con el apoyo de una de las compañías de servicios financieros más grandes y confiables del mundo.

Aprenda más sobre nuestro …

– Ripple (@ripple) 9 de julio de 2025

BNY brings a trunkload of “expertise” and a healthy appetite for innovation—by which we mean, engaging in just enough blockchain flirtation to keep the regulators happy and the board of directors awake. Apparently, the partnership is a “shared commitment to building the infrastructure for the future of finance,” though it sounds suspiciously like a promise to clean up after a particularly wild party. 💸

For those keeping score: RLUSD, Ripple’s darling, is not out to be a casino chip. It’s a New York DFS child—regulated, dollar-backed, and designed to please institutional suitors rather than the speculating rabble. Scandalously responsible.

And as if things weren’t sufficiently respectable, Ripple is now applying for a banking license. Yes, darling, a banking license—because why merely disrupt when one can acquire a government-sanctioned ticket to cocktail parties?

“BNY brings together demonstrable custody expertise and a strong commitment to financial innovation in this rapidly changing landscape. Their forward-thinking approach makes them the ideal partner for Ripple and RLUSD,” reads the announcement, attributed to Jack McDonald, Ripple’s SVP of Stablecoins—possibly the only man in crypto who maintains a straight face while counting stablecoins.

RLUSD is backed, so they say, 1:1 by “high-quality liquid assets”—cash, equivalents, US treasuries, and possibly the lost hopes of meme-coin investors. Max Keiser, ever the Bitcoin evangelist, points out that everyone’s hoarding treasuries these days. At least some traditions never die.

Meticulously audited, strictly reserved, and pledging clear redemption rights, RLUSD is so responsible it may one day lecture you about wearing clean socks. (Institutions and regulators adore that sort of thing.)

The Swiss, never ones to miss a well-guarded vault, have dived in: AMINA Bank now offers RLUSD custody and trading for those seeking the rare thrill of regulated clarity in a world of digital mischief.

RLUSD is now available at AMINA Bank

In collaboration with @Ripple, AMINA enables a regulated, secure, and seamless way to custody and trade RLUSD – ideal for both institutions and individuals who demand clarity, compliance, and control.

Your digital dollars are protected…

— AMINA Bank (@AMINABankGlobal) July 3, 2025

Ripple’s RLUSD: A Cinderella Story (But With Fewer Talking Mice)

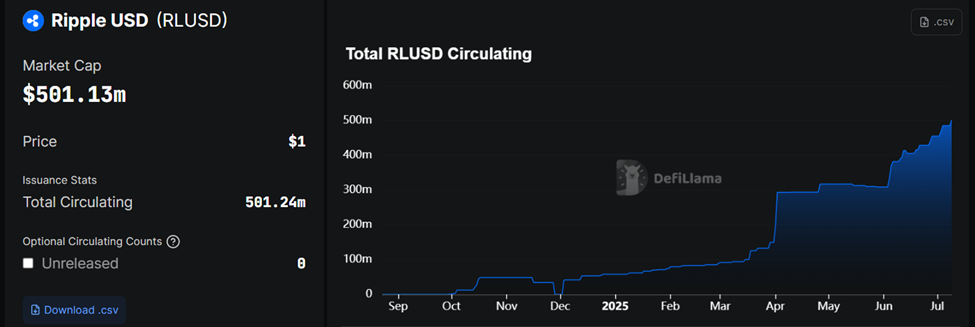

Ripple’s prudent obsession with Wall Street-grade security appears timely: RLUSD’s circulating supply, in true social climber fashion, has soared past $500 million in only seven months. One can only imagine the blushes on Tether’s cheeks. RLUSD was minted in December 2024 and already rubs elbows with the stablecoin elite—ranked 16th on DeFiLlama, after a 47% surge last month. Breathtaking, really. 🔥

@Ripple’s RLUSD stablecoin is growing on @ethereum, with supply up ~4x since January.

— Token Terminal (@tokenterminal) June 28, 2025

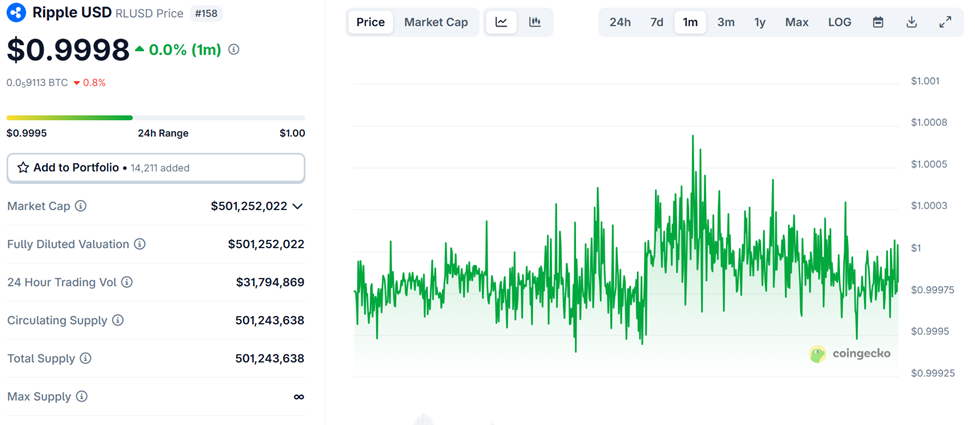

According to CoinGecko, RLUSD trades around $26 million a day, occasionally gathering up the courage to nudge $32 million. One imagines a stately waltz of cross-border remittance and institutional trading, rather than a frantic disco.

The stablecoin market now counts more than $255 billion, with dollar-tethered tokens dominating—because who needs variety when one can have the dollar?

RLUSD’s meteoric rise is proof that, in crypto as in dinner parties, nothing impresses like a good pedigree and proper supervision.

The Obligatory Chart (For Those Who Think In Numbers)

Bite-Sized Alpha (Yes, With a Yawn)

Curtain Up: Crypto Equities Pre-Market Theatre

| Company | At the Close of July 8 | Pre-Market Overview |

| Strategy (MSTR) | $396.94 | $399.03 (+0.53%) |

| Coinbase Global (COIN) | $354.82 | $357.00 (+0.61%) |

| Galaxy Digital Holdings (GLXY) | $19.46 | $19.50 (+0.21%) |

| MARA Holdings (MARA) | $17.52 | $17.70 (+1.03%) |

| Riot Platforms (RIOT) | $11.57 | $11.70 (+1.12%) |

| Core Scientific (CORZ) | $14.02 | $14.18 (+1.14%) |

- USD CLP PRONOSTICO

- USDE PRONOSTICO. USDE criptomoneda

- FET PRONOSTICO. FET criptomoneda

- TRUMP PRONOSTICO. TRUMP criptomoneda

- AVAX PRONOSTICO. AVAX criptomoneda

- USD PLN PRONOSTICO

- EUR GBP PRONOSTICO

- EUR AED PRONOSTICO

- BNB PRONOSTICO. BNB criptomoneda

- ¡No creerás lo que hacen las ballenas de Solana! 🤑🐳

2025-07-09 18:13