Injective (INJ), the Layer 1 blockchain that’s like a Broadway show that just won’t quit, has seen a dramatic spike in daily active addresses (DAAs) in July. 🎉

Despite the INJ token taking a nosedive of 80% from its all-time high (ATH), the network’s resurgence is like a phoenix rising from the ashes. What’s driving this sudden growth? Let’s dive into the comedy of errors and triumphs behind the surge. 🚀

Injective Network Rebounds in 2025, DAAs Hit Highest Since December 2023

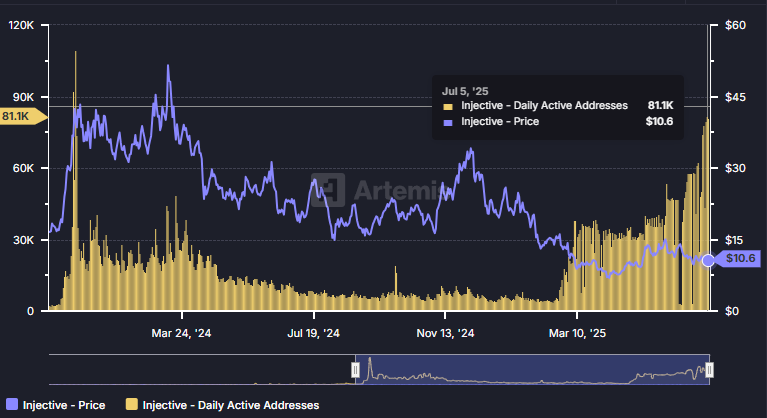

Data from Artemis Analytics shows INJ’s daily active addresses have skyrocketed from 4,500 at the beginning of 2025 to over 81,000 in July, a surge of more than 1,700%. It’s like the network went from a sleepy town to a bustling metropolis overnight! 🏙️

This marks the highest level since December 2023, when the INJ price climbed from $1.25 to over $50. Talk about a rollercoaster ride! 🎢

As a result, many investors speculate that the network’s renewed activity could signal a fresh price rally for INJ in 2025. It’s like the network is saying, “I’m baaaack!” 🎤

“INJ daily active addresses pumped +1,500% to 82,500 in 6 months. Injective is growing exponentially and this is just the beginning,” analyst Lennaert Snyder commented. It’s like he’s seen the future, and it’s glowing! 🌟

The rise in DAAs appears to have started after February 17. Injective rolled out a major protocol upgrade known as the Nivara Upgrade on that date. The community approved it with high participation, and it was expected to improve network performance, attracting more users and developers. It’s like they gave the network a much-needed shot of espresso! ☕

By July, DAAs doubled compared to Q2 averages. One major driver behind this growth was Injective’s launch of its Ethereum Virtual Machine (EVM) Public Testnet. It’s like they opened the gates to a new world of possibilities for developers. 🚀

On July 3, 2025, Injective announced the testnet rollout. It allows developers to build and run Ethereum-compatible decentralized applications (dApps) directly on Injective’s Layer 1 blockchain. It’s like they’re saying, “Come one, come all, and build your dreams with us!” 🎉

Is Injective (INJ) Undervalued?

In 2025, Injective accelerated its token burn rate by 5x following the launch of INJ 3.0. The weekly protocol revenue burn mechanism has reduced token supply and introduced deflationary pressure. However, it hasn’t yet translated into a price recovery amid the ongoing altcoin winter. It’s like they’re trying to thaw out a frozen turkey, but it’s taking a while. 🦃

Despite project development and strong on-chain metrics surpassing 2024 levels, INJ is still 80% below its ATH of $52. According to data from BeInCrypto, INJ is hovering around $10.5, down 60% year-to-date. It’s like the token is saying, “I’m on sale, folks!” 🛍️

Some investors now believe INJ is severely undervalued.

“Injective INJ is massively underrated. If you’ve been paying attention: Major devs, partners, and launches are lining up behind the scenes, preparing for a wave of product rollouts that could make everything to date look small,” investor CryptoBusy said. It’s like he’s seen the secret sauce! 🌭

Amid growing exchange interest in tokenized stocks and assets, Injective could re-emerge as a leading Layer 1 network for real-world asset tokenization — a space gaining increasing institutional and retail traction. It’s like they’re about to become the next big thing, and you don’t want to miss it! 🚀

- USD CLP PRONOSTICO

- AVAX PRONOSTICO. AVAX criptomoneda

- TRUMP PRONOSTICO. TRUMP criptomoneda

- LTC PRONOSTICO. LTC criptomoneda

- XRP PRONOSTICO. XRP criptomoneda

- USD HUF PRONOSTICO

- GBP CAD PRONOSTICO

- EUR AED PRONOSTICO

- El token ASTER cae: las ballenas cobran 2 millones de dólares en una liquidación épica 🐋💸

- Venta masiva de ETH de 74 millones de dólares de ETHZilla: ¿drama de deuda o apuesta bajista? 🚀💸

2025-07-07 17:28