En el año 2025, Real-World Assets (RWA) hizo una entrada espectacular, dejando a todos preguntándose si se trata de un capricho fugaz o del comienzo de una nueva era. 🧙♂️✨ La pregunta ahora es: ¿podrá este impulso sobrevivir a la inevitable tormenta, o fue simplemente un paseo mágico en unicornio? 🦄

No nos andemos con rodeos: esta pieza es un mapa del tesoro con tres tokens RWA que podrían salvar su billetera criptográfica del abismo. O al menos retrasar su descenso. 🗺️

Finanzas de arce (JARABE)

Los RWA fueron la narrativa criptográfica más rentable de 2025, con ganancias promedio de más del 185% según CoinGecko. Ese contexto es importante porque Maple Finance se ubica en el segmento crediticio de esta tendencia y terminó el año con un alza interanual de alrededor del 109%, con un reciente aumento del 7,5% que muestra que el impulso sigue vivo. 🧠⚡

¿Qué criptonarrativas tuvieron las mayores ganancias en 2025?

Nuestro último estudio muestra que Real World Assets (RWA), Layer 1 y Made in USA emergieron como las narrativas más rentables este año.

Lea el estudio completo:

– CoinGecko (@coingecko) 26 de diciembre de 2025

Es una plataforma de préstamos institucionales donde las empresas piden prestado capital a través de actividades crediticias reales, y los prestamistas obtienen rendimientos vinculados al crédito en cadena, no a las emisiones inflacionarias. Este posicionamiento mantiene a Maple Finance en la lista corta de tokens RWA a tener en cuenta en 2026. 🏦💸

El CMO de Bitget, Ignacio Aguirre Franco, le dice a BeInCrypto en exclusiva que el desempeño de Maple en 2025 debe entenderse en contexto:

«Los precios pueden aumentar mucho más rápido de lo que justificarían la adopción subyacente o los ingresos», afirmó.

Añade que el precio no es la métrica en la que confiar de cara al próximo año:

«De cara a 2026, priorizaríamos la expansión de los ingresos y los volúmenes de liquidación como métricas clave a tener en cuenta», destacó

Esto concuerda con la opinión de Konstantin Anissimov, director ejecutivo global de Currency.com, quien cree que la vía crediticia todavía tiene espacio para crecer a medida que madure la adopción de RWA:

«Es probable que el crédito en cadena sea el siguiente. Hay una demanda real de él… pero no crece en línea recta», destacó en conversación exclusiva con BeInCrypto.

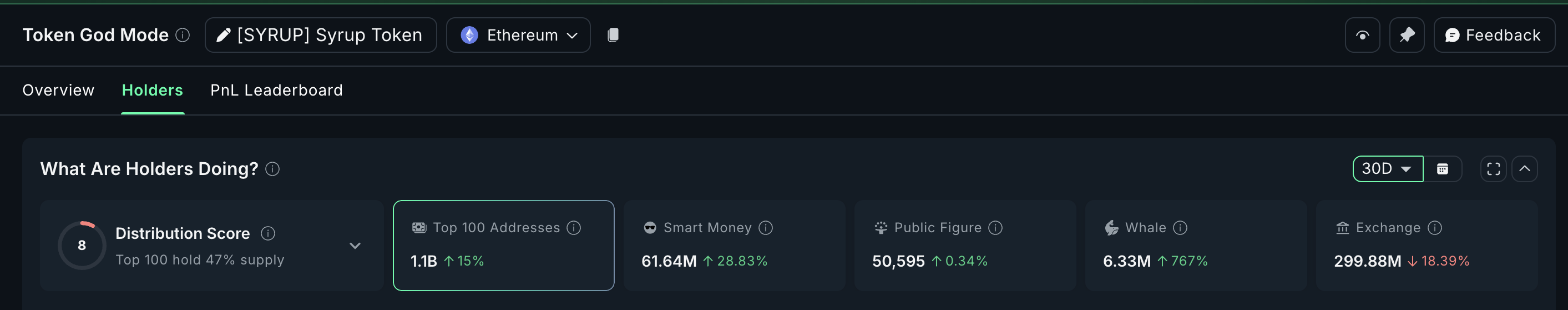

On-chain data supports this interest. In the last 30 days, whale holdings are up 767% to about 6.33 million SYRUP, adding roughly 5.6 million tokens. 🐟📈

Mega-whales increased holdings by 15%, and smart money addresses added around 28%. 🧠💰

The chart validates the whale and smart money interest. It shows a cup and handle pattern forming with consolidation inside the handle. A breakout above $0.336 starts the move, and clearing the sloped neckline near $0.360 confirms it. 🧨

That projection targets $0.557 (about +60% from confirmation). Weakness emerges under $0.302, and the pattern breaks under $0.235. ⚠️

Chainlink (LINK)

Chainlink did not enjoy the same breakout as application-layer RWA projects in 2025. It closed the year down about 38% year-on-year and now trades near $12.37. It has gained 1.7% in the last seven days, but the recovery is slow and uneven. 🐢

Even so, it remains one of the infrastructure-layer RWA tokens to watch in 2026 due to its relevance to institutional rails and data integrity. 🏗️

This positioning aligns with what Ignacio Aguirre Franco told BeInCrypto when asked why infrastructure projects may matter more as adoption matures.

He explains that platforms like Chainlink sit closer to the trust layer needed for real settlement:

«Chainlink and Stellar exist at the infrastructure layer… the former provides trusted data and verification that other applications rely on.

Both are crucial when dealing with tokenized assets tied to real-world value. And both of these platforms have been doing their job for years, which naturally makes them attractive choices for institutional investors who gravitate towards trust and stability,» he mentioned

He adds that this is where institutions are likely to gravitate:

«Institutions don’t want to deal with experimental systems at every layer, so having trusted infrastructure underneath and flexible applications on top makes the most sense as a way forward,» he emphasized

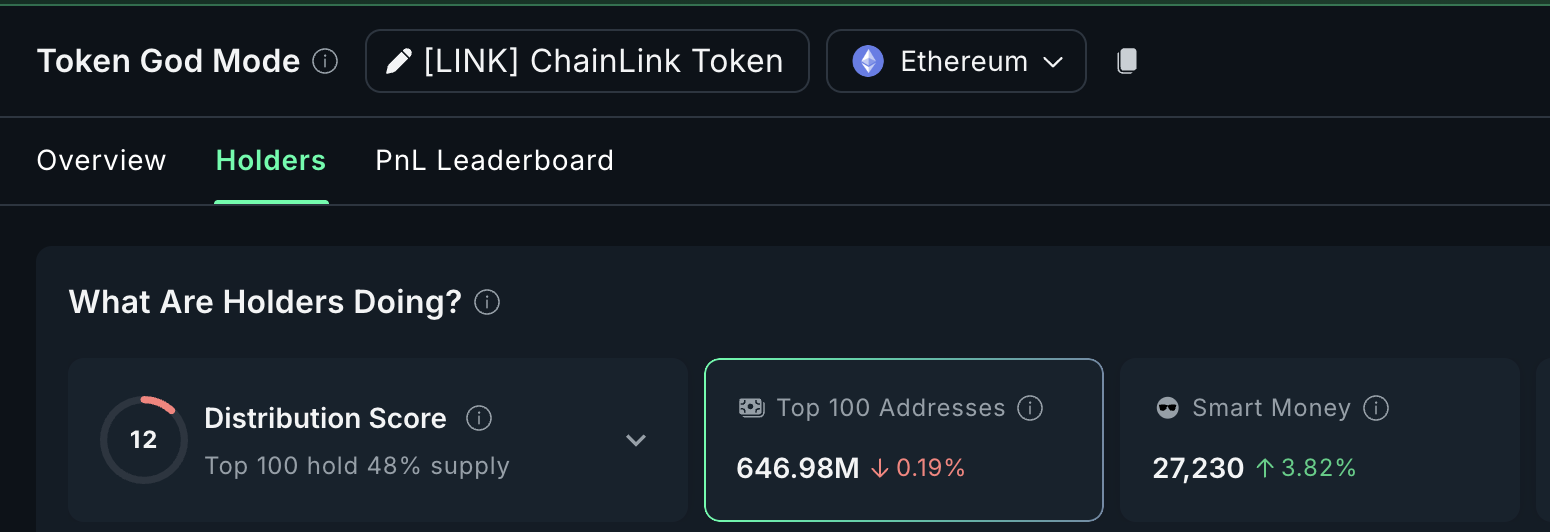

Smart money behavior reflects that shift. In the last seven days, smart money addresses increased holdings by 3.82%, even as mega whale balances dropped. This suggests selective accumulation instead of broad confidence, but it is still notable during a weak period. 🧠

The chart shows a double bottom forming near $11.73, with RSI (Relative Strength Index), a momentum indicator, posting higher lows. When price retests a support level while the RSI rises, it signals bullish divergence and suggests sellers are losing strength. This is the earliest sign of a potential trend change. 🦄

LINK has bounced a bit since.

For continued upside, LINK needs to break $12.45 to confirm a short-term lift. Above that, $13.76 is the next key level. It is a resistance that stopped the last rally on December 12 and has not been reclaimed since. 🚧

If price breaks $13.76 with continued smart money inflow, LINK could move toward $14.24 and even $15.01, where momentum decisions are likely. A breach of the $11.75 line could weaken the bullish hypothesis and weaken the LINK price structure. ⚠️

Zebec Network (ZBCN)

Zebec Network sits in the real-time payroll and money-movement segment of RWAs. It was one of the best performers of 2025 with a year-on-year gain of about 164%, but the last three months have been rough. It is still down around 42% in that period and now trades near $0.0023. 🐌

The token is flat in the last 24 hours and is trying to regain momentum. Even so, its use case keeps it on the list of RWA tokens to watch in 2026. 🚀

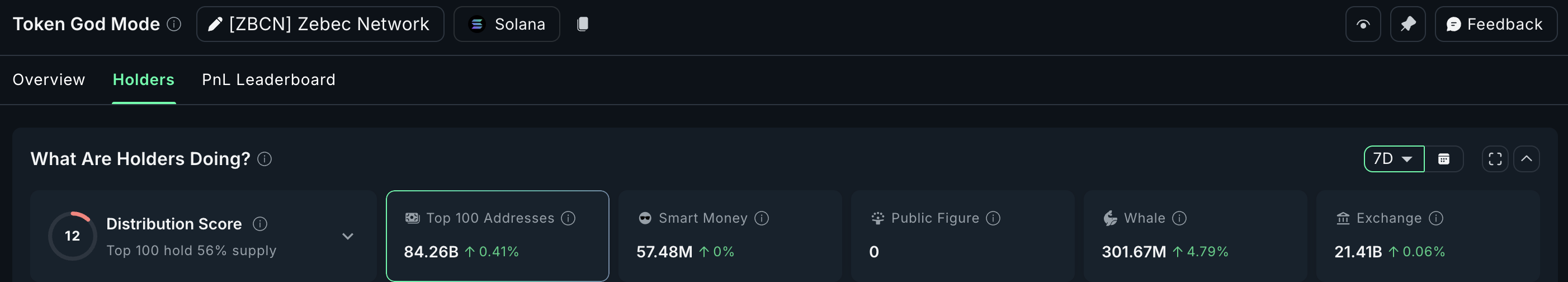

Whales recently re-entered. In the last 7 days, large holders increased their balances by 4.79% to about 301.67 million ZBCN, adding around 13.8 million tokens. 🐟

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That is happening right at a key support zone (later explained on the chart). This support may be the reason whales are testing entries here despite the weak broader trend. 🧠

However, Konstantin Anissimov of Currency.com highlights this point about segment-based survival, pertaining to the Zebec Network:

«Real-time payroll is the segment most vulnerable to rotation… Without continuous usage growth, this sector would struggle the most during market rotations,» he mentioned

This quote matters because it draws the line for Zebec: whale buying helps, but real usage still needs to show up. 🧠

Technically, the setup is simple. The structure becomes mildly bullish only if ZBCN reclaims $0.0030. That level was lost on November 29, and a move above it would be about +28% from current prices. Above that, $0.0036 and $0.0041 are the next checkpoints. Holding those would confirm that buyers are actually following whales into the market. 🧨

If $0.0021 breaks (the key support hinted at earlier), the support argument disappears, and whale optimism gets tested. The next downside area sits near $0.0014, which would be the short-term invalidation of the RWA recovery case for Zebec. ⚠️

- USD MXN PRONOSTICO

- USD CLP PRONOSTICO

- SOL PRONOSTICO. SOL criptomoneda

- USDE PRONOSTICO. USDE criptomoneda

- SHIB PRONOSTICO. SHIB criptomoneda

- BCH PRONOSTICO. BCH criptomoneda

- BTC PRONOSTICO. BTC criptomoneda

- PEPE PRONOSTICO. PEPE criptomoneda

- USD HUF PRONOSTICO

- XRP PRONOSTICO. XRP criptomoneda

2026-01-01 01:43